south dakota sales tax filing

If you are stuck or have questions you can contact the state of South Dakota directly by telephone at 605 773-3311 or via email at bustaxstatesdus. Payments are due the 25th of each month.

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

Username must be minimum of 8 characters and cannot contain the following characters.

. Ad Apply For Your South Dakota Sales Tax License. Depending on the volume of sales taxes you. The penalty for a failure to pay within 30 days of the due date is 10 of the tax due for every month you are delinquent with a minimum charge of 10.

In addition to the sales tax cities can levy a 2 municipal sales and use tax and a 1 municipal gross receipts tax on certain goods and services. You have two options for filing and paying your South Dakota sales tax. Compliance is complicated and time-consuming in South Dakota because of the multiple local taxing levels that must be monitored and maintained on a.

Complete in Just 3 Steps. Filed via Paper includes paper filing fee 765. The South Dakota Department of Revenue will accept cash payment in person at one of their offices.

. Calculating Sales Tax In order to file sales tax you have to do a sales tax calculation to know precisely how much you owe the state before making the payment. Penalties and interest apply to late returns or payments.

How to File and Pay Sales Tax in South Dakota. All retail sales including the sale lease or rental of tangible personal property or any goods transferred electronically as well as the sale of services are subject to the sales tax. Charge the tax rate of the buyers address as thats the destination of your product or service.

Returns must be filed even if no amounts are due. Filed via Paper includes paper filing fee 165. .

File online File online at the South Dakota Department of Revenue. Amended or Restated Domestic Articles. Amended Foreign Certificate of Authority.

The South Dakota sales tax is 45 for businesses. Payment options are ACH Debit or credit card. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission.

Businesses can also pay over the phone by calling 800 829-9188. 12 rows Calendar of South Dakota Sales Tax Filing Dates. Department of Revenue Remittance Center PO Box 5055 Sioux Falls SD 57117-5055 Please note that if you file your South Dakota sales taxes by mail it may take significantly longer to process your returns and payments.

Enter the following information. You select the Username. Enter the South Dakota license number exactly as displayed on the license card.

Late filing of your South Dakota sales tax returns or late payment of the tax due will result in penalties imposed by the state. 1200 PM 1200 PM Wednesday July 20 2022. Tax calculation filing of tax returns and tax payments.

The business has gross sales into South Dakota exceeding 100000. Due dates for retail sales tax. Filing a South Dakota sales tax return is a two-step process comprised of submitting the required sales data filing a return and remitting the collected tax dollars if any to the South Dakota DOR.

All the information you need to file your South Dakota sales tax return will be waiting for you in TaxJar. Avoid The Hassle and Order Your Sellers Permit Online Hassle-Free. South Dakota Department of Revenue.

The process of filing sales tax in South Dakota consists of three primary steps. There are additional levels of sales tax at local jurisdictions too. Also there are some conditions that are subject to the South Dakota sales tax.

South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501-3185 Local Phone Sales Tax Department. How to Get Help Filing a South Dakota Sales Tax Return. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year.

When a filing or payment due date falls on a Saturday Sunday or legal holiday the filing or payment is due the next business day. South Dakota Sales Tax Filing Address. Filed via Paper includes paper filing fee 65.

Search for a job. Tribal governments may also levy a sales tax. Go to our Filing and Tax Payment Portal.

1 Toll Free Phone Sales Tax Department. All you have to do is login. Tax Return Filing Due Date.

Jul 20 Jul 20. South Dakota has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state. The filing process forces you to detail your total sales in the state the amount of sales tax collected and the location of each sale.

Foreign Certificate of Authority. The state-wide sales tax in South Dakota is 45. You can remit your payment through their online system.

Sales Tax Exemption Sd State Auditor

South Dakota S Marketplace Facilitator Sales Tax Law Explained Taxjar

South Dakota V Wayfair A Taxjar Perspective Taxjar

Internet Sales Tax Definition Types And Examples Article

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

How Do State And Local Sales Taxes Work Tax Policy Center

E Commerce And Sales Tax Youtube Sales Tax Commerce Ecommerce

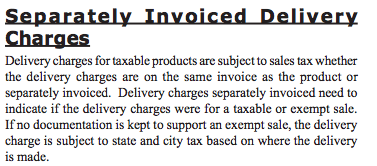

Is Shipping Taxable In South Dakota Taxjar

.png)

States Sales Taxes On Software Tax Foundation

Sales Tax Exemption Sd State Auditor

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Use Tax Laws Regulations South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

South Carolina Sales Tax Small Business Guide Truic

South Dakota And Sd Income State Tax Return Information

State Corporate Income Tax Rates And Brackets Tax Foundation